Cash Flow Management System – the Lifeblood of Your Business

Admin

Subscribe

Cash flow is the inflow and outflow of money from a business. It provides funds for daily operations, including paying rent/mortgage, utilities, taxes, operating costs, and employees, and acquiring inventory.

Having positive cash flow means you are earning more than you are spending. Negative cash flow means you are not. If you don’t have working capital, you don’t have a business.

The Folly of Chasing Revenue

Cash flow is the lifeblood of your business and revenue is the heartbeat that keeps it circulating. But be careful. Avoid falling for the “if we could just get to $XX million in revenue, we could get profitable” trap.

Cash flow is the lifeblood of your business and revenue is the heartbeat that keeps it circulating. But be careful. Avoid falling for the “if we could just get to $XX million in revenue, we could get profitable” trap.

We have seen countless field service business owners chase revenue as a cure-all. What’s the problem with that? You can be profitable on paper but still not have funds to meet your monthly obligations.

Make positive cash flow and healthy net profit your financial goals and you will have more and better options for growth.

The Power of Positive Cash Flow

Positive cash flow makes a company more liquid. It provides more available cash to pay debts, reinvest in the business, provide profits to shareholders, pay expenses, and have a cash safety net for emergencies. There are many more reasons to have strong positive cash flow, but here are five of the best.

- Business Viability – Research by US Bank found that 82% of small business failures result from inadequate cash flow. Being viable means you still will be in business tomorrow to serve your customers and attract top talent.

- Better Planning and Decision Making – A positive cash flow projection enables you to make realistic plans for growth or expansion. It also keeps you from getting over-extended and lets you act when it is in your best interest, not someone else’s.

- Self-Finance Business Growth – If you want to grow your business (and who doesn’t?) you need cash. You can borrow it if you have good credit. You can use your own cash, if you have it, or use some combination of cash and financing. The more you use your own money, the more control you have.

- Business Valuation – Positive cash flow is the biggest thing you can do to increase valuation because each dollar of cash flow adds $7 – $15 to the value of your business. You may have no immediate plans to sell but you should manage your business at all times as if you do. When your business ultimately does change hands, you will get more for it.

- Keep Suppliers Happy – Suppliers tend to treat customers better when they pay on time. And they’re more likely to help you when you really do need a break.

Profit Depends on Positive Cash Flow

Being profitable is a process. First, you need revenue, which produces cash flow, which produces profits – if you manage your expenses well.

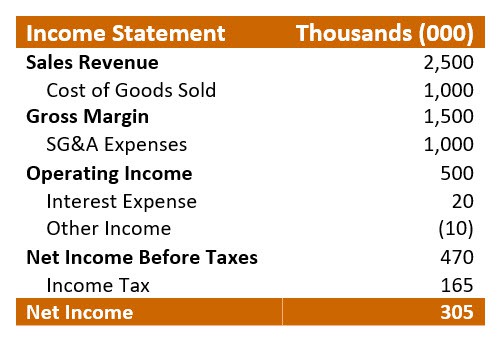

Financial analysts consider three types of profits – gross profit, operating profit, and net profit – all of which can be found on your Income Statement in QuickBooks. It’s also called a Profit & Loss Statement, or simply a P&L.

Financial analysts consider three types of profits – gross profit, operating profit, and net profit – all of which can be found on your Income Statement in QuickBooks. It’s also called a Profit & Loss Statement, or simply a P&L.

You probably are familiar with these terms but to avoid any confusion, this is how we define them. The article from Investopedia.com provides more detail.

- Gross profit = This is revenues minus the expenses directly associated with selling goods and services, including products, parts, and field labor. Gross profit is the first hurdle. It provides a rough estimate of profitability and your ability to meet current expenses.

- Operating profit = This further subtracts operating expenses and shows how well you are allocating your resources after deducting all the costs of doing business. It also helps you find unnecessary operating expenses you can eliminate.

- Net profit = this is what is left for the company after accounting for all negative and positive cash flows. This is how much you really made in a given period. Good net profit is what enables you to keep serving customers and grow.

Profits Are Not the Same as Cash!

The terms revenue, profit, and cash are closely related, but each has a distinct meaning. Revenue is income from the sale of goods and services. Profit is an accounting term that reflects the viability of a business. It shows that you have something left over when all the bills are paid. Cash is what pays the bills.

A business can be profitable but cash poor and unable to meet current obligations, very much like a homeowner with a mortgage.

A person’s income may qualify him for a mortgage, but if he spends too much, overuses credit, has little savings, and his paycheck arrives late, he has a cash flow problem.

Positive cash flow is about having sufficient money on hand to pay your obligations as they come due. It’s also important to build in some cushion for unexpected events, such as a spike in gas prices or a period of high inflation. That not only makes you pay more for everything, inflation eats into your receivables when your customers decide to pay the mortgage instead of paying you.

Positive cash flow is about having sufficient money on hand to pay your obligations as they come due. It’s also important to build in some cushion for unexpected events, such as a spike in gas prices or a period of high inflation. That not only makes you pay more for everything, inflation eats into your receivables when your customers decide to pay the mortgage instead of paying you.

Positive cash will keep you ahead of expenses. A weak cash position will handicap your business and stunt its growth. If not corrected, it can bankrupt the business. This article from a business insurer, The Hartford, provides additional insights on managing profit and cash flow.

Three Fundamental Financial Statements

Cash flow isn’t something you should try to calculate in your head because it isn’t intuitive. Making sales doesn’t mean you have cash on hand. Incurring expenses doesn’t mean you have paid your bills. Inventory usually shows up as a cost of sales well after it is bought and paid for.

If you find such mental gymnastics confusing, you’ll probably find it much easier to use financial statements to lay out all the information in front of you.

Cash flow and other key financial performance indicators are much easier to visualize in these three must-have financial reports.

- Income statement (P&L) – documents revenues, expenses, gains, and losses for a given period.

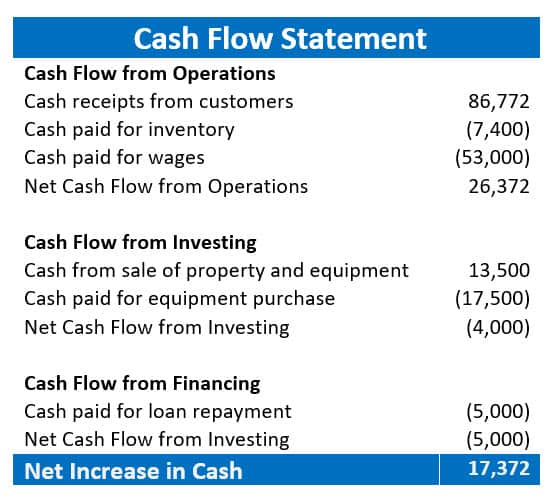

- Cash flow statement – summarizes the amount of cash and cash equivalents entering and leaving a company.

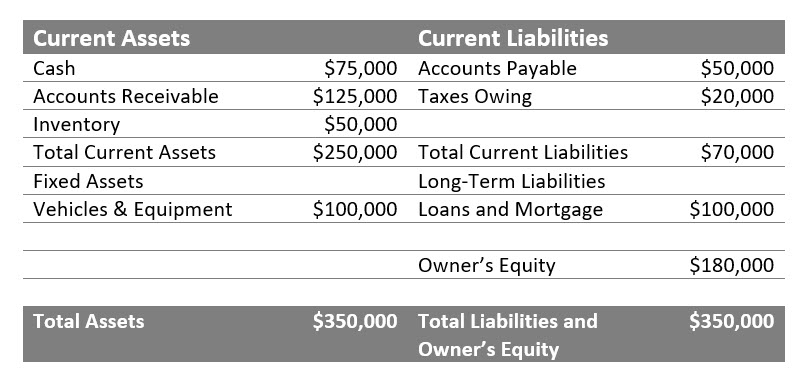

- Balance sheet – shows total assets equal to total liabilities + owner’s equity.

INCOME STATEMENT – The simplified Income Statement shown here provides a wealth of information about revenue, cash flow, and profit. This report shows how much a business has earned during a given period, usually a month, quarter, or year.

The P&L Statement shows gross income, net income, cash flow, and earnings, and it provides the numbers you need to calculate gross and net profit margins. It is so critical to business success that we built every feature of Sera FSM software to have a laser focus on boosting profitability through increased operational efficiency and reducing overhead.

Instead of complex math and pricing formulas, Sera uses your data to set net profit margins that practically assure your success.

CASH FLOW STATEMENT – The Cash Flow Statement considers cash moving from business operations, investing, and financing to provide a full accounting of your cash position for a given period.

CASH FLOW STATEMENT – The Cash Flow Statement considers cash moving from business operations, investing, and financing to provide a full accounting of your cash position for a given period.

The bottom line shows the amount by which cash flow increased or decreased over the previous month, quarter, or year. The example here shows improvement.

Collectively, the P&L, Cash Flow Statement, and Balance Sheet show the profitability, liquidity, solvency, and efficiency of any business.

BALANCE SHEET – This simplified balance sheet illustrates the matching relationship between assets and liabilities.

NOTE: You can access all of these reports in QuickBooks. The formats will vary. You will find it worthwhile to review them carefully each month.

Common Cash Flow Problems and Solutions

Businesses of any type anywhere can experience liquidity problems. Most do, at one time or another. If that happens, find the cause and fix it as fast as you can. Here are some of the causes we see repeatedly in field service businesses.

Inadequate Pricing – Although it may seem obvious, pricing often is not the first place business owners turn to improve cash flow. In most cases, it should be. If you are using time & material or flat-rate pricing, you may want to consider margin pricing to establish your profit margins before setting prices. Sera field service management software calculates it for you.

Poor Budgeting – Timely bookkeeping is a must for tracking your budget and maintaining positive cash flow. Commit to how much revenue you expect to receive during a given period and track your daily progress.

If you see you’re running behind schedule, slow the cash drain by looking for areas to cut expenses and ways to work more efficiently. Then turn up your marketing efforts to attract more business.

Inventory Management – Having sufficient parts and new equipment inventory is a must to serve your customers professionally. Inventory that stays on shelves ties up cash and lines of credit. Stock the essentials and take advantage of good prices when they are available but speed up inventory turnover to keep the cash moving.

Delayed Payments – Customers today expect to pay at the time of service, so there is no need to delay payments or mail out invoices. Using even the most basic technology techs can issue invoices and accept payments on location when each job is complete.

High Overhead – No matter how efficiently your techs work, your profits can go down the drain if indirect expenses for office staff, rent, utilities, supplies, and insurance, are too high. Track overhead expenses each month looking for places to save money.

Premature Business Expansion – When you start growing revenue you inevitably start planning to add staff, trucks, equipment, and perhaps more office or warehouse space. Do so with your eyes wide open.

Growth is a big cash drain. Unless you have exceptionally good cash flow, you’ll need financing. The faster you grow the more you need. You can find yourself adding overhead faster than revenue.

Chasing Revenue – All of this discussion should make it obvious that adding revenue will not fuel growth without strong positive cash flow. First, attack the causes of your liquidity problems. Look for ways to reduce overhead and improve operational efficiency. Then, find proactive ways to increase revenues.

A Sure Way to Build Positive Cash Flow

If you don’t have a membership plan, or if you have one that’s not working for you, this article has some eye-opening numbers about the money-making math of membership plans, including:

- Building a six-figure recurring revenue stream from subscription fees.

- Average revenue from members is 2.5 times higher than for non-members.

- How you can keep techs busy generating revenue year-round.

- How membership plans automatically create more sales opportunities and boost revenue.

We consider memberships so important that we built membership management into Sera field service management software.

Sera – Field Service Management Software Based on P&L

Sera field service management software simplifies your business by automating the routine and repetitive tasks of scheduling and dispatching so your employees can spend more time helping customers directly.

There is far more to Sera than an integrated scheduling and dispatching software solution. Sera FSM software was designed from the ground up as a total business cash flow management system based on managing profit & loss, building recurring revenues, positive cash flow, repeat business, and referrals to boost your profits fast.

Sera customers who have switched from other FSM software have recorded 50% or more revenue increases in the first six months after starting with Sera while boosting operating efficiency by 30%.

There’s nothing else to buy, no extra modules, no extra cost. Get a personal demonstration now.

Sera’s FSM software uses your P&L and other financials to set profitable pricing, while dramatically reducing overhead to produce positive cash flow.”

GET A FREE DEMO

Conclusion

Cash flow – the inflow and outflow of money from a business – is essential for the viability of any business. It makes planning and decision-making easier and less stressful. It also makes your business more valuable when it eventually changes hands.

Positive cash flow provides funds for daily operations, including paying rent/mortgages, utilities, taxes, payroll, operating costs, and employees, and acquiring inventory.

While positive cash flow is necessary for a business to be profitable, profits and cash should not be confused. Profit is a measure of viability, but cash pays the bills. Increasing revenue offers no solution to poor cash flow without reducing expenses and improving efficiency.

Field service business owners should use three basic financial performance reports found in QuickBooks – the Income Statement (P&L), Cash Flow Statement, and Balance Sheet – to track business health routinely. Common causes of liquidity problems in field service businesses include inadequate pricing, poor budgeting, inventory management, delayed payments, high overhead, premature business expansion, and chasing revenue instead of building positive cash flow.